![]()

EZENET ACQUIRES WEALTH MANAGEMENT SOLUTIONS INC.

EZENET TECHNOLOGIES NOW DEPLOYED IN ALL OF CANADA'S SCHEDULE 1 BANKS

TORONTO, ONTARIO (September 7, 2000) - EZENET Corp. (TSE:EZE) today closed the previously announced acquisition of Wealth Management Solutions Inc. (WMSI), a Toronto-based software development company. The acquisition of WMSI is the second of recent acquisitions made by EZENET since raising $50 million in special warrant financing earlier this year.

The acquisition of WMSI increases EZENET employees by 120 percent and adds senior management and technical strength to EZENET's operations. WMSI's 1999 revenues (year ended December 31) of $4 million, combined with its debt-free status and profitability will add to revenues and increase EZENET's existing positive operating cash flow.

The WMSI acquisition solidifies EZENET as the one-stop shop to the financial industry for all software and technology needs. WMSI's comprehensive wealth management software enhance EZENET's extensive list of software solutions offered to the financial industry which include; checking and savings accounts, GICs systems, investment plans, mortgage administration, network management, security services, Internet banking, and wireless applications. EZENET's software and integrated technologies are now deployed in all of Canada's Schedule 1 banks.

WMSI was acquired for $5 million and the issuance of 505,051 common shares. Should WMSI achieve certain fiscal 2000 revenue targets, EZENET will make additional deferred payments of up to an aggregate $1 million and 101,010 in common shares to former WMSI shareholders. 98.3% of the shares issued in this transaction are subject to an escrow agreement between EZENET and certain former WMSI shareholders, releasable at various times over a 30-month period.

"Along with our dedication to developing new products and expanding our technology solutions, EZENET is committed to seeking acquisitions that will significantly enhance EZENET's revenues, intellectual capital, infrastructure, and shareholder value. The acquisition of WMSI significantly enhances EZENET in all of these criterion," stated Kasra Meshkin, EZENET's President and CEO. "We have already begun integration and plans for maximization of the joint strengths of EZENET and WMSI are currently underway."

Jay Cashmore, founder and President of WMSI, will join EZENET as President of Canadian Operations and become a member of EZENET's Board of Directors. Jay Cashmore brings over 30 years of experience in the financial services industry, including 5 years as President of FootPrint Software Inc. and over 2 years as President of WMSI.

"This is a significant opportunity for EZENET and WMSI. I expect that we will capitalize on our combined operations and expand our joint markets and infrastructure. This enables us to offer more extensive solutions to the financial industry throughout North America," stated Jay Cashmore. "Throughout negotiation of this acquisition I have had a chance to work closely with EZENET's senior management and the great synergies between the two companies is already apparent. The WMSI team is excited about the integration of our companies and our products."

About Wealth Management Solutions Inc.

The management and staff of Wealth Management Solutions Inc. (WMSI) have been developing software exclusively for the financial services sector since 1983 and is the recognized leader in the development of investment plan and asset administration systems. WMSI's wealth management solutions enable their clients to conduct business in an efficient and profitable manner so that they, in turn, may more efficiently service the needs of their customers - wealth management investors. WMSI offers a wide range of products and services including, mortgage underwriting and management systems, mortgage backed securitization, bond management and processing systems, and the full spectrum of investment plan and asset administration systems. These systems are available on a license basis for in-house operation or under a fully secure Application Service Provider (ASP) offering. WMSI was named as one of the top 25 "Up-and-Comers" in an annual survey of Canadian IT companies conducted by Branham Group Inc. ("The Financial Post Magazine, March 1999"). More information can be viewed at www.wmsi.ca.

![]()

EZENET OPENS U.S. HEAD OFFICE

NEW PRESIDENT OF U.S. OPERATIONS TO DEVELOP NATIONAL SALESFORCE

TORONTO, ONTARIO (August 16, 2000) - EZENET Corp. (TSE:EZE) announced announced the opening of its first U.S. office in Morrisville (Research Triangle Park), North Carolina. The office in Research Triangle Park will operate as the company’s U.S. head office and technology hub. Within the next 12 months EZENET plans to open branch sales offices in New York, Los Angeles, Dallas/Fort Worth and Chicago.

“We are excited about our aggressive sales and marketing push into the United States,” said the new President of U.S. Operations, Jeffrey Coyne. “By combining our unique competitively priced offerings with our 20-year history of developing financial software applications and secure on-line banking systems, we believe EZENET will shape the future of mobile e-commerce across North America.”

EZENET’s modular solutions will be delivered to midsize U.S. banks and financial institutions from the office in North Carolina. EZENET’s current list of Canadian clients will continue to be served from their corporate headquarters in Toronto, Canada.

“A member of our board of directors, Jeffrey Coyne has represented more than 100 U.S. and foreign banks during his extensive legal career. Jeff has significant presence and credibility within the financial industry,” said Kasra Meshkin, President and CEO, EZENET Corp. “Jeff knows how to assemble and manage a sales organization. Jeff and his team of sales professionals will roll out our complete end-to-end integrated solutions for banks, other financial institutions and e-tailers in the United States.”

Meshkin believes that the company’s aggressive U.S. expansion plans will allow EZENET to provide integrated technology services across the new generation of Internet and wireless-enabled devices to a receptive target audience. “Our technology offerings have been well received by the business world,” said Meshkin. “From a single program to a totally integrated end-to-end financial and banking solution, EZENET will offer the U.S. marketplace a wide array of products, services and applications across a range of networks, platforms and transport mediums.”

With its range of integrated solutions, EZENET can put a midsize U.S. financial institution at the forefront of technology with significant cost savings. EZENET acts as an extension of, and in some cases, in place of, a client's IT department.

![]()

EZENET ANNOUNCES SECOND QUARTER RESULTS

MAINTAINS POSITIVE OPERATING CASHFLOW

TORONTO, ONTARIO (August 15, 2000) - EZENET Corp. (TSE:EZE) announced today its results for the second quarter ended June 30, 2000. The Company's progress on a number of initiatives is summarized below.

Second Quarter Highlights

- Positive operating cash flow of $300,683 for the six months ended June 30, 2000

- Closing of the acquisition of Netstor Technologies Inc.'s proprietary servers

- Signed a letter of intent to purchase the shares of Wealth Management Solutions Inc.

- Expansion into the U.S. and opening of an office in North Carolina

- Addition of two independent directors

- Toronto Stock Exchange listing

For the six months ended June 30, 2000, a net loss of $45,184 or $0.01 per share was recorded. This compares to net income of $244,118 or $0.04 per share for the same period in 1999. Expenses increased for the six months ended June from $946,785 in 1999 to $2,288,545 in 2000, however, they were offset by revenue increasing from $1,384,283 in 1999 to $2,208,961 in 2000, resulting in a loss before taxes for the six months ended June 30, 2000 of $79,584. The Company generated a positive cash flow from operations of $300,683 for the six months ended June 30, 2000.

Two major items contributed to the increase in expenses. The first was the amortization of deferred development costs of $272,100 in the first half of 2000 (nil in 1999) and the second is the increase of salaries, wages and benefits from $574,279 in 1999 to $1,303,424 in 2000. The number of personnel has increased from 18 as at June 30, 1999 to 37 as at June 30, 2000. In addition to key management appointments in corporate, finance and administration, marketing and research and development, the Company has also strengthened its financial systems, information systems and research and development personnel.

On June 6, 2000 the Company announced that it had closed the acquisition of Netstor Technologies Inc. proprietary servers, which are tailored directly to the needs of Internet Service Providers, Application Service Providers and Wireless Application Protocol services. The Company has used this technology to develop wireless applications for our clients.

A letter of intent to purchase the shares of Wealth Management Solutions Inc. ('WMSI') was signed on July 21, 2000. The purchase was funded by $5 million in cash and 505,051 common shares. An additional $1 million in cash and 101,010 common shares will be issuable if certain revenue targets are attained. WMSI is a private software development company that will broaden the Company's product offerings, expand the client base and add senior management and technical strength to the operations.

The Definitive Purchase Agreement is expected to be signed by August 18, 2000 and closing is expected by the end of August. After closing of the WMSI transaction, the Company will still have approximately $42 million in cash.

Expansion into the U.S. is proceeding as planned. An office in Research Triangle, North Carolina has opened and personnel have been recruited, but not yet hired for the Chicago office. Customization of the financial systems software is well underway and contacts have been made with the Federal Deposit Insurance Corporation ('FDIC') to ensure a smooth completion of the certification, which is expected to be completed in October 2000.

There has been the addition of two independent directors. Mr. Gerald Soloway, President and CEO of Home Capital Group and Mr. Peter Kidnie, CEO of Bank of Montreal Finance Ltd. have joined the Board of Directors. Each brings a wealth of knowledge and over 20 years of experience in the financial services industry to the Board. At the annual meeting, Kasra Meshkin was appointed Chief Executive Officer, formerly held by Haron Ezer. Mr. Ezer will remain with the Company as Chairman of the Board.

Finally, the Company is now trading on the Toronto Stock Exchange effective August 14, 2000.

"In the next quarter, we will be concentrating on the U.S. conversion of our financial systems, expanding our sales force in both Canada and the U.S., integrating WMSI and researching additional acquisition targets. The future of your Company looks most promising," stated Kasra Meshkin.

Canada Newswire/ Yahoo! Webcast

EZENET will host a webcast and teleconference Thursday, August 17th, 2000 to explain the Q2 report along with other significant announcements.

To register and view this event, please enter http://webevents.broadcast.com/canadanews/ezenet0800 in your web browser.

If you do not have internet access, you may simply listen to the audio portion of the webcast by calling: 1-877-323-2011 or 416-695-9705 and asking for the EZENET Corp. conference call. A playback will also be available for 24 hours by dialing 1-416-695-9772. The playback number is 0251.

![]()

EZENET AND HOME TRUST COMPANY LAUNCH WIRELESS

INVESTMENT RATE MANAGER APPLICATION

FIRST WIRELESS APPLICATION FOR EZENET

TORONTO, ONTARIO (August 15, 2000) - EZENET Corp. (TSE:EZE), a leading business-to- business software and integrated technologies provider specializing in banking and wireless solutions, announced today that customers of Home Trust Company, a wholly owned subsidiary of Home Capital Group Inc. (TSE:HCG.B) are now able to access a variety of services, including investment (GIC) rates, from a wireless device.

"EZENET's first wireless application is a significant step in providing the financial industry with the software and technologies necessary to supply their customers' demands with mobile banking applications. EZENET has been the principal financial systems software providers to Home Trust for more than 18 years. Our intimate understanding of the demands of their customers - such as the need for m-commerce - enabled us to develop the right application," stated Kasra Meshkin, President and CEO of EZENET Corp. "To meet the demands of their retail market, we developed this mobile service. We are committed to providing complete end-to-end integrated solutions including wireless applications to our growing customer base and our current list of partners - our clients. We believe our value-added m-commerce services will help shape the future of financial services."

This is EZENET's first commercial wireless integrated technology application. Home Trust's existing and future customers interested in e- commerce services are now able to access financial information across a wide range of Internet-enabled wireless and consumer electronic devices - anytime, anywhere from http://www.hometrust.ca/wireless. Using the new breed of handheld devices, including digital mobile phones, personal digital assistants (PDA's) and 2-way pagers, users access the service through their mobile browser.

"We are pleased to provide our valued customers with wireless access to our deposit-taking services via EZENET's wireless integrated technology," said James Appleyard, Vice-President - Business Development of Home Capital Group Inc. "As Canada's leading mortgage lender to the growing number of Canadian entrepreneurs and to other consumers whose specific needs are not addressed by larger, traditional financial institutions, one of our key goals is to continue to expand our product and service offerings. We believe that this solution takes us another step towards that goal."

Features of Mobile Service Home Trust customers or potential customers are now able to use wireless devices to:

- view current investment (GIC) rates

- access deposit applications for an investment

- connect directly with a Home Trust representative to inquire about or purchase a product

- send Home Trust an e-mail

- retrieve the real-time stock price of Home Capital Group Inc.

- be alerted by e-mail if an investment rate changes significantly.

![]()

EZENET ANNOUNCES TSE LISTING

TORONTO, ONTARIO (August 10, 2000) - EZENET Corp. (CDNX: EZE), a leading software and IT solutions provider to banks and financial institutions, announced today that its common shares will begin trading on The Toronto Stock Exchange ("TSE") as of the start of business on Monday August 14th, 2000. Quotation of EZENET common shares under the symbol EZE on Canadian Venture Exchange (CDNX) will cease as of close of business August 14th, 2000. EZENET’s TSE symbol is EZE.

|

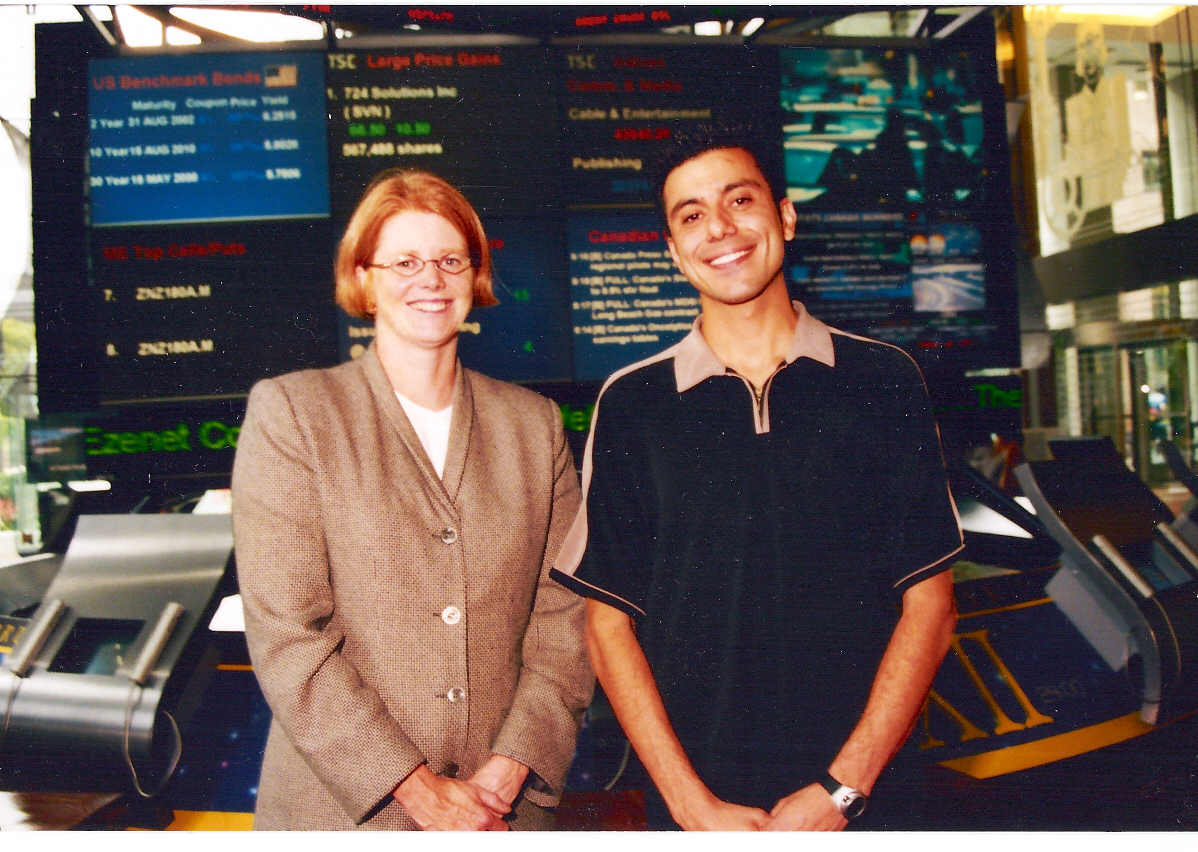

Barbara Stymiest, TSE President and CEO and Kasra Meshkin, President and CEO, EZENET - Aug 2000, Toronto Stock Exchange |

"Our move to the TSE shows the market has confidence in our progressive vision that combines our trusted back-end financial software solutions with innovative wireless-enabled and Internet communications applications," says Kasra Meshkin, President and CEO, EZENET. " Achieving a listing on the prestigious TSE will allow us to further develop our partnership, affiliation and acquisition strategies. This will facilitate our ability to provide complete end-to-end integrated solutions for banks, other financial institutions and e-tailers that will help EZENET shape the future of mobile e-commerce.”

Meshkin and other members of the company’s senior management team have scheduled an online briefing into the state of the company on August 17, 2000 at 10:30 a.m. via Canada NewsWire/Yahoo!. Media and investors are invited to attend. More details on the webcast, such as the specific URL, will be announced shortly.

EZENET TO ACQUIRE WEALTH MANAGEMENT SOLUTIONS INC.

ACQUISITION ALLOWS EZENET TO EXPAND PRODUCT OFFERING, ACCELERATE U.S. EXPANSION, AND INCREASE CLIENT BASE

TORONTO, ONTARIO (July 21, 2000) - EZENET Corp. (CDNX: EZE), a leading software and IT solutions provider, announced today that it has signed a letter of intent to purchase all of the issued securities of privately-held Wealth Management Solutions Inc. (WMSI), a Toronto- based software development company. WMSI is EZENET's second acquisition since closing a $50-million Special Warrant financing earlier this year.

The proposed acquisition will expand EZENET's client base, broaden its product offerings, increase EZENET employees by 120 per cent and add senior management and technical strength to EZENET's operations. WMSI's 1999 revenues (year ended December 31) of $4 million, combined with its debt-free status and profitability, make WMSI a significant and strategic investment for EZENET. EZENET customers and strategic alliance partners will benefit from the wealth management solutions offered by WMSI, which complement EZENET's financial service offerings.

The purchase will be funded by $5 million in cash and 505,051 of common or convertible preferred shares, which will be determined in the definitive agreement and priced. Furthermore, should WMSI achieve certain fiscal year 2000 revenue targets, Ezenet will make an additional deferred payment of up to $1 million in cash and 101,010 in common or convertible preferred shares. The shares issued in this transaction will be subject to an escrow agreement between EZENET and the WMSI shareholders, releasable at various times over a 30-month period.

The Agreement is subject to a number of conditions, including execution of a definitive Purchase and Sale agreement and requisite regulatory approvals. The transaction is expected to close in early August.

"This transaction is part of EZENET's ongoing strategy to establish a critical mass in Canada, expand our product offerings to financial institutions, along with accelerating our entry into the U.S. market," said Kasra Meshkin, President and Chief Executive Officer of EZENET. "Since going public in March 1999, EZENET has continued to build on its strong foundation with additions to management, targeted acquisitions, and technology developments. This acquisition is a logical step in our long-term development strategy. We believe there to be excellent synergies between EZENET and WMSI."

Following the closing of this transaction, Jay Cashmore, founder of WMSI, will join EZENET as President of Canadian Operations and become a member of EZENET's Board of Directors. Jay Cashmore brings over 30 years of experience in the financial services industry, including 5 years as President of FootPrint Software Inc. and over 2 years as President of WMSI.

"There is powerful synergy between our two companies," said Mr. Cashmore. "EZENET's acquisition of WMSI will allow the combined entity to accelerate development of its wealth management software, for distribution in both Canada and the U.S. market to meet the growing demand for consolidated investment plan management. Our companies' combined experience in the financial services market, in conjunction with our firms' technical proficiency, makes this transaction a mutually beneficial undertaking for all our staff, our customers, and our investors."

With more than 15 years in the wealth management sector, WMSI brings EZENET experienced management, new and distinct product lines, positive cash flow and a team of well-respected professionals from the financial services industry.

About Wealth Management Solutions Inc.

The management and staff of Wealth Management Solutions Inc. (WMSI) have been developing software exclusively for the financial services sector since 1983 and is the recognized leader in the development of investment plan and asset administration systems. WMSI's wealth management solutions enable their clients to conduct business in an efficient and profitable manner so that they, in turn, may more efficiently service the needs of their customers - wealth management investors. WMSI offers a wide range of products and services including, mortgage underwriting and management systems, mortgage backed securitization, bond management and processing systems, and the full spectrum of investment plan and asset administration systems. These systems are available on a license basis for in-house operation or under a fully secure Application Service Provider (ASP) offering. WMSI was named as one of the top 25 "Up-and-Comers" in an annual survey of Canadian IT companies conducted by Branham Group Inc. ("The Financial Post Magazine, March 1999"). More information can be viewed at www.wmsi.ca.

![]()

EZENET RECEIVES TSE CONDITIONAL LISTING APPROVAL

TORONTO, ONTARIO (July 18, 2000) - Ezenet Corp. (the "Corporation") has received conditional listing approval from the Toronto Stock Exchange for its common shares and common share purchase warrants. Listing is subject to fulfillment of usual conditions and is expected to be completed in early August. Immediately following listing on the Toronto Stock Exchange, the Corporation expects to delist its securities from the Canadian Venture Exchange.

![]()

CLARIFICATION OF BLOOMBERG REPORT ON EZENET

TORONTO, ONTARIO (July 6, 2000) - As a matter of clarification with respect to certain recent Bloomberg reports, Ezenet is advised by each of Haron Ezer, Kasra Meshkin, Terry Rogers and Gordon Ramer that they have not sold any common shares of Ezenet into the market.

![]()

EZENET RECEIVES FINAL RECEIPT FOR SPECIAL WARRANT PROSPECTUS

TORONTO, ONTARIO (July 6, 2000) - EZENET Corp. ("Ezenet") today announced that it has obtained receipts for its final prospectus from the British Columbia, Alberta, Manitoba and Ontario Securities Commissions. The final prospectus qualifies for distribution in British Columbia, Alberta, Manitoba and Ontario 4,611,200 Common Shares and 2,305,600 Share Purchase Warrants issuable upon exercise of 4,611,200 Special Warrants of the Corporation. Each Warrant will enable the holder thereof to purchase one Common Share at a price of $12.00 until 5:00 p.m. on September 12, 2001. The deemed exercise of the Special Warrants will occur effective 5:00 p.m. (Toronto time) on July 12, 2000, being five (5) business days from the issuance of the receipts for the Corporation's final prospectus.

The Special Warrants were issued on March 23, 2000 at a price of $11.25 per Special Warrant for gross proceeds of $51,876,000. Each Special Warrant is exercisable, for no additional consideration, for one (1) Common Share and one-half Warrant of Ezenet. The balance of the proceeds from the Special Warrant offering held in escrow pending receipts for the final prospectus; namely $31,125,600 (together with accrued interest), was released to Ezenet today.

![]()

EZENET ADDS INDEPENDENT DIRECTOR FROM BANK OF MONTREAL

TORONTO, ONTARIO (June 16, 2000) - Haron Ezer, Chairman of the Board of EZENET Corp. (EZENET), a leading software and IT Solutions Provider to the financial industry, is pleased to announce the addition of Peter Kidnie, Chief Executive Officer of Bank of Montreal Finance Ltd., to the EZENET Board of Directors.

Mr. Peter Kidnie brings a wealth of knowledge to the EZENET Board of Directors and over 20 years of experience in the financial industry. Prior to his current position with the Bank of Montreal, Mr Kidnie has held positions with Ford Motor Company. Mr Kidnie has an in-depth understanding of EZENET's IT solutions through his position with the Bank of Montreal, where EZENET's applications are currently deployed.

"A successful company needs good people and great minds behind it," stated Haron Ezer EZENET's Chairman. "EZENET has therefore continued to add valuable members to its Board, Officers, and Employees to the Company. The latest addition of Peter Kidnie to the Board is a further example of this philosophy."

In addition, at EZENET's recently held Annual General Meeting (AGM), shareholders approved the stock option plan under which options to purchase 2,450,000 shares, of which 1,977,000 had been issued prior to the AGM leaving 473,000 which are available for issuance to eligible Directors, Officers, and Employees of EZENET and its subsidiaries. These options will enable EZENET to offer employee incentives and to attract exceptional people in this competitive technological marketplace.

EZENET APPOINTS NEW CEO, ADDS INDEPENDENT DIRECTOR, AND CLOSES NETSTOR ACQUISITION

TORONTO, ONTARIO (June 6, 2000) - Haron Ezer, Chairman of the Board of EZENET Corp. (EZENET), a leading software and IT Solutions Provider to the financial industry, is pleased to announce additions and changes to the executive management of the company. Kasra Meshkin, President of the Company, has been appointed to Chief Executive Officer. In addition, Mr. Gerald Soloway, President of Home Capital Group (TSE: HCG.B) and a customer of EZENET, has been elected to the EZENET Board of Directors. Haron Ezer, EZENET founder and former CEO will remain as EZENET's Chairman of the Board.

Kasra Meshkin, who assumed the role of President and Chief Operating Officer earlier this year, will serve as EZENET's President and Chief Executive Officer. Prior to his Presidency, Mr. Meshkin was EZENET's Vice President of Research and Development for ten years. Kasra Meshkin is a major shareholder of the company and director.

Mr. Gerald Soloway brings experience of managing a TSE listed company, and the knowledge of the financial industry to the EZENET Board of Directors. Mr. Soloway is President and Chief Executive Officer of Home Capital Group Inc., a publicly traded company that operates through its principal subsidiary, Home Trust Company. In addition, Mr. Soloway, possesses an in-depth knowledge of EZENET from a client perspective, as EZENET has been providing software and IT solutions for Home Trust Company, since 1982. Mr. Soloway also holds the office of Chairman of the Canadian Trust Institute, which is composed of all non-bank owned trust companies in Canada.

"The company is in a very favourable position; in the last 5 weeks we have added 2 people to the senior management team, an additional independent Director, and we maintain positive cash flow, all significant factors as we continue our growth and expansion," stated Haron Ezer EZENET's Chairman.

EZENET also closed the previously announced (all asset acquisition) of NetStor Technologies Inc. NetStor's proprietary servers, which are tailored directly to the needs of ISPs (Internet Service Providers), ASPs (Application Service Providers), and WAP (Wireless Application Protocol) services, are therefore expected to reduce EZENET's development time on wireless and Internet Banking. Additionally, NetStor's security enhanced version of the Linux operating system will further enhance Ezenet's solution offering. The acquisition price was $750,000 with the issuance from treasury of 50,000 common shares ($15.00 per share) of EZENET Corp.

To accommodate expansion and growth, EZENET has relocated its head Toronto office to:

5160 Yonge Street

11th Floor

Toronto, Ontario, CANADA

M2N 6L9

![]()

EZENET ENTERS YEAR 2000 POISED FOR GROWTH AND EXPANSION

TORONTO, ONTARIO (May 30, 2000) - The first quarter ended March 31, 2000 was highlighted by the closing of a Special Warrants financing that resulted in the issuance of 4,444,500 special warrants at a price of $11.25 per special warrant for gross proceeds of $50,000,625. Net proceeds of $48,125,953 were distributed by releasing $17,000,353 to the Company, while $31,125,600 is being held in escrow pending the issuance of receipts for the final prospectus. It is with these proceeds that the Company is planning an ambitious, yet conservative strategy of core business, geographical and product expansion.

For the period ended March 31, 2000, a net loss of $47,925 or $0.01 per share was recorded, as compared to net income of $117,817 or $0.03 per share in the prior year. Amortization of product development cost was $136,050 for the quarter, with no expense recorded last year. In preparation for the implementation of the Company's growth strategy, the Company established professional alliances in marketing, public and investor relations and began building an infrastructure of key personnel. As a result, salaries, administration, professional fees and investor relations increased from $394,860 to $639,757. The Company continued to generate positive cash flow from operations of $72,307 compared to $233,887 last year.

FINANCIAL HIGHLIGHTS

| Details | For the Quarter Ended

March 31, 2000 |

For the Quarter Ended

March 31, 1999 |

| Revenue | $854,168 | $659,014 |

| Research and development expense | 136,050 | - |

| Net income (loss) | (47,925) | 117,817 |

| Earnings (loss) per share | ($0.01) | $0.03 |

| Cash flow per share | $0.01 | $0.05 |

| Working capital | $17,251,985 | $861,064 |

The first quarter saw restructuring and key hires to the senior management team. Kasra Meshkin was appointed as President and C.O.O. on February 23, 2000. The Company proceeds into the last three quarters of fiscal 2000 debt free and with financial resources for both expansion and acquisition. We have entered into an agreement with a financial advisor in identifying strategic partners and potential acquisitions. In addition, the expansion into the United States will continue with the opening of an office in North Carolina in the second quarter.

Mr. Meshkin stated, "Fiscal 2000 will be an exciting year for Ezenet Corp. With a strong infrastructure in place, I am confident that we have the management team that will allow for the smooth transition of Ezenet Corp. to becoming a technological leader to the financial services industry."

All shareholders and guests to are invited to attend the Annual General Meeting of Shareholders, which will be held in the Kensington Room of the Le Royal Meridien - King Edward Hotel, 37 King Street East, Toronto, Ontario Today (May 30, 2000) at 4:00 p.m. Shareholders and guests are also invited to join Directors and Management for refreshments following the Annual General Meeting.

![]()

EZENET SEEKS STRATEGIC PARTNERS AND ACQUISITIONS

TORONTO, ONTARIO (May 25, 2000) - EZENET Corp. (CDNX: EZE), a leading software and IT solutions provider to financial institutions, is pleased to announce that it has engaged Octagon Capital Corporation to act as its financial advisor in identifying strategic partners and potential acquisitions. This complements and strengthens EZENET's expansion and development plans, which include wireless applications, establishment of a U.S. presence, and development on the Linux platform.

Octagon Capital Corporation acted as lead agent for the recently completed $50 million special warrant financing and continues to maintain a close relationship with the company.

"Octagon's knowledge of EZENET, combined with our strong working relationship will accelerate the search for strategic companies that will help grow our business," stated Kasra Meshkin, EZENET's President and Chief Operating Officer. "We are confident that Octagon has the necessary resources and contacts to identify businesses which will help expand our company and complement our development."

"We are pleased to be adding value by providing continuous service to EZENET, now and on a going forward basis" says Oliver Meixner, a partner at Octagon. "EZENET is in an extremely strong position as it is cash rich and focused on growing its presence in North America. Octagon is currently reviewing a number of attractive opportunities for EZENET to realize its growth objective"

About OCTAGON CAPITAL CORPORATION

Octagon Capital Corporation is an independent, technology focused, investment banking partnership that creates wealth through innovative ideas. Octagon has offices in Toronto and Calgary, seats on the TSE and CDNX, and is a member of the Investment Dealers Association.

![]()

AMONG THE BEST PERFORMERS FOR THE YEAR

TORONTO, ONTARIO (May 15, 2000) - Canadian Internet-related companies are down an average 58% from their 52-week highs, but are still up 352% from their 52-week lows, a report shows.

A Research Capital report surveyed 61 Canadian Internet-related companies, from behemoth Nortel Networks Corp. (NT/TSE) to small junior-exchange listed companies. Though the group is off sharply from its 52-week highs, it is still up an average 7% in 2000 as of Thursday's close, the report says.

And though technology stocks have corrected in the past two months, some still showed big gains in 2000.

Among the best performers for the year to date are Ezenet Corp. (EZE/CDNX), up 256%, Informission Group Inc. (IFN/TSE), up 135%, and Tecsys Inc. (TCS/TSE), up 108%.

![]()

EZENET'S PRESIDENT TO BE INTERVIEWED ON CFRB 1010

TORONTO, ONTARIO (May 9, 2000) - EZENET Corp's. (CDNX: EZE), president, Kasra Meshkin, will be interviewed today at 5:52 PM. Kasra Meshkin will be interviewed on "CFRB 1010". The interview will focus on Ezenet's current products and services, as well as the company's future growth plans in light of the closing of the equity financing of $50 million dollars announced last week. The interview will be live and rebroadcasted throughout the day.

![]()

EZENET'S PRESIDENT TO BE INTERVIEWED ON CP24

TORONTO, ONTARIO (May 03, 2000) - EZENET Corp's. (CDNX: EZE), president, Kasra Meshkin, will be interviewed today at 11:45am. Kasra Meshkin will be interviewed on "Cable Pulse 24". The interview will focus on Ezenet's current products and services, as well as the company's future growth plans in light of the closing of the equity financing of $50 million dollars announced last week. The interview will be live and rebroadcast throughout the day.

![]()

EZENET STRENGTHENS MANAGEMENT TEAM WITH NEW APPOINTMENTS

TORONTO, ONTARIO (May 2, 2000) - EZENET Corp. (CDNX: EZE), a leading software and IT solutions provider to financial institutions, is pleased to announce a number of new appointments to its management. Marc Nicholas joins Ezenet as Chief Technology Officer, Gary Guthro joins as Chief Financial Officer, and Terry Rogers takes on the role of Vice President Financial Systems.

These new appointments serve to further strengthen Ezenet's management team as the company moves into a period of expansion, acquisition and new product development, including wireless banking solutions, Internet technologies and Linux-based applications.

Marc Nicholas was formerly President of netSTOR Technologies, the Toronto-based developer of network server appliances acquired by Ezenet on April 27, 2000. Marc Nicholas has a strong track record in information technology, Internet consulting and telecommunications. He brings a wealth of experience to Ezenet, including international consultancy for telecommunications and wireless start-ups. As a part of his appointment, Marc Nicholas will step down from the EZENET Board of Directors where he has served since March 1999.

Terry Rogers C.A., who has been with Ezenet since 1995, takes on responsibility for new business development, and the design and implementation of Ezenet's financial solutions across Canada. Terry Rogers has an extensive background in corporate finance and operations, formerly serving as Ezenet's Chief Financial Officer.

Gary Guthro C.A. joins Ezenet from Home Capital Group Inc. (a TSE listed company HCG.B) where he held the position of Vice President Finance. Gary Guthro has over 18 years of experience in financial management, investment analysis and operational management in such companies as Home Capital Group Inc., Philips Services Inc. and Peat Marwick Thorne.

"We are delighted to have put in place a strong and distinguished management team as we enter this exciting period of expansion and development," stated Kasra Meshkin, EZENET's President and Chief Operating Officer. "Our team combines the experience, business excellence and entrepreneurial spirit needed to compete effectively in the North American information technology market. We welcome these individuals and look forward to their contribution to the organization."

![]()

EZENET ANNOUNCES RECORD YEAR END RESULTS

REVENUES INCREASED BY 37% AND CASH FLOW BY 50%

TORONTO, ONTARIO (May 1, 2000) - EZENET CORP, (CDNX: EZE) a leading software and IT provider to Financial Institutions today announced record results for the year ended December 31, 1999. EZENET generated revenues of $3.2 million, an increase of 37% over the previous year's results, while cash flow from operations reached $926,000 ($0.09 per share), an increase of 50% over the prior year. Net earnings after taxes were $262,000 or $0.04 per share, after writing off $180,000 in R & D expenses.

In its first year as a publicly traded company, EZENET continued to build on its profitable business model. During fiscal year 1999, EZENET added new clients in the financial services sector, expanded its services to existing clientele, completed integration to IBM RISC 6000 processors, and enhanced its already comprehensive list of software solutions. Additionally, EZENET successfully launched InstaBase, a unique and powerful Internet software program, for which it established worldwide contacts and distribution channels. During the last quarter of the year, EZENET commenced the expansion of its banking services with significant additions of research and development employees as well as the purchase of equipment necessary to support this effort.

"We are particularly pleased to report that we have now delivered three straight years of record revenue growth, as we continue to expand our already profitable business model. During the 1999 fiscal year, EZENET invested heavily in Research and Development with internally generated funds and funds from the private placement of Common Shares completed early in 1999. In 1999 our aggressive investments in Research and Development, particularly those in the fourth quarter, positions EZENET for significant growth which culminated with the raising of $50 million in Special Warrant financing in March 2000," stated Haron Ezer, EZENET's Chairman and CEO. EZENET will utilize these proceeds to develop front-end wireless solutions for banks and financial services companies that complement Ezenet's existing back end infrastructure, for development of enhanced security software, for marketing and sales force expansion into the United States; and to develop Linux Financial applications.

Mr. Ezer continued "EZENET is now well prepared for significant growth and expansion in all facets of our business. Our strategic development expenditures in 1999, combined with our strong management team, and the addition of new financing, will enable the company to further strengthen its position as a technological leader for the financial services industry as we enhance our financial solutions across wireless and Internet technologies. EZENET has already begun this expansion by initiating our U.S. expansion, furthering our development, and hiring key employees. EZENET will continue to move rapidly forge ahead and continue our growth as we take our innovative solutions and generate new revenue streams and enhance shareholder value."

FINANCIAL HIGHLIGHTS

| Details | Year Ended 31/12/1998 Audited | Year Ended 31/12/1999 Audited |

| Revenues | $2,345,708 | $3,206,448 |

| Net Earn. A/Taxes | $278,544 | $261,734 |

| Earnings Per Share | 9.0 cents | 4.0 cents |

| Cash Flow/Share | 10.0 cents | 14.0 cents |

| Net Income/Sales | 11.9% | 8.2% |

The full financial results are available on the SEDAR web site at www.sedar.com and on the company's web site at www.ezenet.com.

Ezenet's fourth quarter of 1999 was heavily influenced by the company's decision to begin ramping up operations in anticipation of the planned expansion in 2000. Revenues for the 4th quarter of 1999 were $909,063 compared to $599,014 in 1998. Costs for the quarter were $1,098,678 compared with $693,143 in 1998. In the 4th quarter of 1999, the company instituted a policy of writing off Deferred R&D expenses for the first time and the charge in the 4th quarter was $181,400. The company will follow a policy of writing off all R&D expenses as incurred in the coming year. During the quarter, significant costs and resources were committed to the execution and testing of EZENET's hardware and software to ensure Y2K compliancy. The company added programming staff and infrastructure in both the Banking operations and in PC software development. These expenses were funded from internally generated cash flow. The company also began the process of obtaining new equity funding, for future expansion, which resulted in the closing of a Special Warrant offering of $50 million that closed on March 24, 2000.

On December 31, 1999, the company had cash on hand of $170,469, continuing our policy of maintaining a strong cash position from internally generated funds. Current Assets were $529, 272. Current liabilities were $140,401 at December 31, 1999. The Working Capital Ratio was 3.8:1. EZENET remained and continues to remain debt free. With the change of the company from a private to public company in 1999, the charge for future income taxes increased significantly over 1998.

![]()

EZENET TO ACQUIRE NETSTOR TECHNOLOGIES INC.

TORONTO, ONTARIO (April 27, 2000) - EZENET Corp. (CDNX: EZE), a leading software and IT solutions provider to Canadian financial institutions, announced today that it has entered into an agreement to acquire all of the assets of netSTOR Technologies Inc. (NetStor), a Toronto-based developer of network server appliances. This acquisition is part of EZENET's development of a complete wireless banking solution and movement to the Linux platform, and follows last month's completion of $50 million in new equity financing.

NetStor's proprietary servers, which are tailored directly to the needs of ISPs (Internet Service Providers), ASPs (Application Service Providers), and WAP (Wireless Application Protocol) services, are therefore expected to reduce EZENET's development time on wireless and Internet Banking. Additionally, NetStor's security enhanced version of the Linux operating system will further enhance Ezenet's solution offering.

"This acquisition is a significant step for Ezenet, in terms of expediting our development as a complete software and technology solution provider for North American financial institutions," said Haron Ezer, Ezenet's Chairman and Chief Executive Officer. "NetStor strengthens our infrastructure and helps us accelerate our development roadmap. Their servers and technology platforms are significant for Ezenet's wireless development, and we believe that their compatibility with Sun servers and Linux makes them superior to others in the marketplace."

The acquisition price of $750,000 will be satisfied by the issuance from treasury of 50,000 common shares ($15.00 per share) of EZENET Corp. No finder's fee is payable in connection with this transaction. The closing of the transaction, expected to occur on or about May 10, 2000, is subject to completion of due diligence and regulatory approval.

NetStor's Founder and President Marc Nicholas along with EZENET's President and COO Kasra Meshkin, collectively own all of NetStor's shares. As part of this acquisition, Marc Nicholas, who currently sits on the EZENET Board of Directors, will join EZENET as Chief Technology Officer. This transaction has been approved by an independent committee of EZENET's Board of Directors.

About netSTOR

NetStor's proprietary server appliances are specifically designed and tailored to deliver one or more network-based applications for Internet, ASP (Application Service Provider), Wireless, and Telecommunication Providers. They are less expensive, less complicated, and less susceptible to complex software errors than similar products in the marketplace. NetStor recently announced a new product range of server appliances based on Sun Microsystem's UltraSPARC AXe technology platform - one of the few products currently available to come pre-configured with Sun Microsystem's enterprise class Solaris 8ª operating system or the Linux operating system. For further information visit NetStor's website at http://www.netstor.com.

![]()

EZENET APPOINTS PRESIDENT OF U.S. OPERATIONS

TORONTO, ONTARIO (April 25, 2000) - EZENET Corp. (CDNX: EZE), a leading software and IT solutions provider to Canadian Financial Institutions is pleased to announce the appointment of Jeffrey C. Coyne as President of U.S. Operations. The appointment of Mr. Coyne is the first part of EZENET's North American expansion and development of a complete wireless banking solution, and follows EZENET's completion last month of $50 million in Special Warrant financing. Mr. Coyne is currently a member of EZENET's Board of Directors and has developed key relations and experience in the U.S. financial sector over the last twenty years.

"Jeff Coyne has developed a thorough understanding of EZENET's capabilities and direction as a member of our Board of Directors. He has been able to add a broader scope to our operations, products and services that has ultimately lead to this decision. We are confident that with his experience in the U.S. financial industry and his extensive U.S. contacts, he will successfully establish a strong EZENET presence in the United States," stated Kasra Meshkin EZENET's President and Chief Operating Officer. "Jeff was originally brought on to the EZENET Board to help guide and advise EZENET on our plans for a U.S. expansion - now he will lead and manage those operations."

Jeffrey Coyne has been a member of EZENET's Board of Directors since January 2000. He has represented over 100 U.S. and foreign banks during his legal career and has substantial U.S. contacts and experience within the financial industry. He has also built and managed sales organizations in the United States and the Caribbean.

Jupiter research estimates that by 2003, approximately 28 million U.S. homes will be using online banking, up from the 9 million estimated to be using on-line banking today. Ezenet plans to offer the U.S. financial industry its software and IT solutions required to meet this growing demand.

"I am very excited and confident that EZENET will establish a strong U.S. presence and that I can help to shape and broaden its U.S. development. Since the beginning of my association with the company, I have been impressed with their extensive products, technological capabilities, and potential to expand to the U.S. market. Working in the U.S. for over 20 years, I have established many key contacts in the financial industry and with U.S. regulators, which will aid me in taking EZENET's products to this extensive market. The complete solution for financial institutions provided by EZENET, which will be further developed for the wireless environment and Linux systems, will be extremely competitive in the U.S. market," stated Jeffrey C. Coyne.

Jeffrey Coyne, who resides in North Carolina, USA, graduated with a Bachelor of Arts degree from the University of California at Berkeley in 1976 and a Juris Doctor degree from Duke University, School of Law, in 1979. He has been a senior lecturing fellow at Duke University School of Law, from 1994 to the present. He was formerly a partner of Coudert Brothers, Attorneys at Law, New York and Graham and James, Attorneys at Law, San Francisco.

![]()

JEFF LUCAS APPOINTED DIRECTOR OF INFORMATION SYSTEMS FOR EZENET CORP.

TORONTO, ONTARIO (March 31, 2000) - Kasra Meshkin, President of Ezenet Corporation, is pleased to announce the appointment of Jeff Lucas to Director of Information Systems for Ezenet Inc. Jeff Lucas has been Manager Computer Operations, Network Services during the past five years.

Jeff is an expert in NT system administration, Network Design & connectivity, Hardware and remote Network Management.

"Jeff is the perfect choice to administer our growing technical staff and will work closely with our growing management team. Jeff has proven his abilities and loyalty over his term at Ezenet and I am very pleased to announce his appointment." said Kasra Meshkin, President of Ezenet Corporation.

![]()

IAN GUTHRIE APPOINTED DIRECTOR OF RESEARCH & DEVELOPMENT OF EZENET CORP.

TORONTO, ONTARIO (March 30, 2000) - Kasra Meshkin, President of Ezenet Corporation, is pleased to announce the appointment of Ian Guthrie to Director of Research & Development for Ezenet Inc. Ian Guthrie has been in charge of the "Projects" division of Ezenet's R&D during the past two years.

Ian is an expert in UNIX system administration, Project Management, Network Security, Database Design and all aspects of Web and Internet Applications.

"I have great confidence in Ian Guthrie's ability to manage the Research & Development department while our company undergoes rapid expansion and also to lead R&D into the future," said Kasra Meshkin, President of Ezenet Corporation.

![]()

EZENET'S PRESIDENT TO BE INTERVIEWED ON TWO TV PROGRAMS

TORONTO, ONTARIO (March 29, 2000) - EZENET Corp's. (CDNX: EZE), president, Kasra Meshkin, will be interviewed on two Television stations this week. Today, at 3:15pm. Kasra Meshkin will be interviewed on "Cable Pulse 24". Additionally, "Report On Business Television" have also scheduled an interview with Kasra Meshkin on Friday March 31 at 11:15am. Both Interviews will focus on Ezenet's current products and services, as well as the company's future growth plans in light of the closing of the equity financing of $50 million dollars announced last week. Both interviews will be live and rebroadcasted throughout the day.

![]()

EZENET CORP. CLOSES $50 MILLION SPECIAL WARRANT FINANCING

TORONTO, ONTARIO (March 23, 2000) - EZENET Corp. (CDNX: EZE), a leading provider of back-end software and IT solutions for Canadian financial institutions, today announced that it has closed its previously announced offering of 4,444,500 Special Warrants. The Special Warrants were issued at a price of $11.25 per Special Warrant for gross proceeds of $50,000,625. This financing was completed by a syndicate of investment dealers lead by Octagon Capital Corporation and included, Salman Partners Inc. and Acumen Capital Finance Partners Inc.

Each Special Warrant will entitle the holder to acquire one unit ("Unit") comprising one Common Share of the Corporation and one-half of one Common Share Purchase Warrant. Each whole Common Share Purchase Warrant will be exercisable into one Common Share at a price of $12.00 for fourteen months following the Expiry Date (being the earlier of the fifth business day after issuance of the last receipt for the final prospectus and March 23, 2001).

Approximately $20,000,000 (40%) of the issue proceeds was released to Ezenet on closing and the balance of approximately $30,000,000 (60%) will be held in trust pursuant to the Special Warrant Indenture creating the Special Warrants until the issuance of receipts for the qualifying prospectus on or before September 19, 2000, failing which investors may request the repurchase of up to 60% of their Special Warrants for the purchase price plus accrued interest. In the event receipts for a final prospectus are not received from all jurisdictions of filing by July 21, 2000, Special Warrants will be exercisable for 1.1 Common Shares and .55 Common Share Purchase Warrants.

The proceeds of this Offering will be used to further develop the banking software, and front-end wireless and Internet solutions for banks and financial service companies that complement EZENET's existing back-end infrastructure. This includes; development of enhanced security software, marketing and sales force expansion into the United States, development of Linux financial applications and strategic acquisitions related to these matters. A portion of the funding will also be dedicated to further expansion of the Product Software Division of the company, including InstaBase.

"This is a significant day in the history of EZENET and all our shareholders. EZENET has always possessed the products and intellectual property necessary in the technological industry and the vision of where that industry is going. This financing will allow the company to pursue that vision and to expand our complete solution that we currently provide to financial institutions," stated Haron Ezer, EZENET's Chairman and Chief Executive Officer.

"The Company is well prepared for significant growth and expansion in all facets of the business. EZENET's strong management team, coupled with key additions to the company, will enable EZENET to further strengthen its position as a technological leader for the financial industry as we enhance our financial solutions across wireless and Internet technologies," stated Kasra Meshkin, EZENET's President and Chief Operating Officer.

![]()

EZENET CORP. EQUITY FINANCING WITH OCTAGON CAPITAL CORPORATION INCREASED TO MAXIMUM $50,000,000

TORONTO, ONTARIO (March 3, 2000) - In light of opportunities to accelerate corporate growth and due to strong institutional market demand, Ezenet has increased the amount of i t's previously announced financing to an amount of up to $50,000,625. The final offering amount will be determined at closing. The special warrants are priced at $11.25 per special warrant. Each special warrant will entitle the holder to acquire one unit ("Unit") comprising one common share ("Common Shares") and one-half of one Common Share purchase warrant ("Warrant") of the Corporation. Each whole Common Share purchase warrant will be exercisable at a price of $12.00 for fourteen months following the Qualification Date.

The offering is subject to regulatory approval and is expected to close on or about March 21, 2000.

The proceeds of this Offering will be used to develop front-end wireless solutions for banks and financial services companies that complement the Ezenet's existing back end infrastructure, for development of enhanced security software, for marketing and sales force expansion into the United States; and to develop Linux Financial applications.

Ezenet is a Toronto based information technology company providing full service technology and software solutions for the financial and banking industry including online software, network services, full internet capabilities and enhanced security. Ezenet's technology and software solutions are currently deployed in major financial institutions across Canada. Ezenet has many Canadian financial institutions as clients including four of Canada's six largest banks and several of Canada's Trust and Insurance companies. Ezenet's software expertise also allowed for the development of InstaBase, a unique, powerful, yet simple Internet software program, which is currently in distribution worldwide.

![]()

EZENET CORPORATION ANNOUNCES $18 MILLION EQUITY FINANCING WITH OCTAGON CAPITAL CORPORATION

TORONTO, ONTARIO (March 1, 2000) - Ezenet Corp. (EZE - CDNX) announced that it has entered into an agency agreement with Octagon Capital Corporation and Salman Partners Inc. to complete a private placement offering of $18 million in Special Warrants of Ezenet. The Special Warrants will be priced at $11.25 per Special Warrant. Closing of the Offering is expected to occur on or about March 30, 2000.

Each Special Warrant will entitle the holder to acquire one unit ("Unit") comprising one common share of the Corporation ("Common Share") and one-half of one Common Share purchase warrant ("Warrant"). Each whole Common Share purchase Warrant will be exercisable at a price of $12.00 for fourteen months following the Qualification Date. This offering is subject to regulatory approval.

The proceeds of this Offering will be used to develop front-end wireless solutions for banks and financial service companies that complement the Company's existing back-end infrastructure, for development of enhanced security software, for marketing and sales force expansion into the United States; and to develop Linux financial applications.

![]()

KASRA MESHKIN APPOINTED PRESIDENT OF EZENET CORP.

TORONTO, ONTARIO (February 23, 2000) - Haron Ezer, CEO and Chairman of the Board of EZENET Corp. (EZENET), is pleased to announce the appointment of Kasra Meshkin, to President and Chief Operating Officer. Kasra Meshkin assumes the role of President from Haron Ezer who will remain CEO and chairman of the board.

Kasra Meshkin, 33, formerly the Vice President of Research and Development of Ezenet has been in charge of all technology and software development for the last 10 years. Kasra Meshkin is a major shareholder of the company and director.

"This is an exciting day for me, for Kasra, for Ezenet employees, and Ezenet shareholders. Kasra has been with the company for ten years and knows all aspects of our business," stated Haron Ezer. "Kasra is a highly recognized expert in software architecture, computer networks, security, communications, and other technologies, which has positioned Ezenet as a leader in its field. Kasra will spearhead the future growth and expansion of the company, and I have great confidence in his capabilities with which to do it."

Haron Ezer founded Ezenet, formerly known as Ezer & Associates over twenty years ago and has built up the company to its current value. Haron Ezer has lead Ezenet to its current position and has directed the development of all products and services throughout the company's history.

"I am honoured to fulfill this opportunity and very excited about the future of our company," stated Kasra Meshkin. "EZENET has always remained at the forefront of technology and the company will continue on its fast growth track, capitalizing on our substantial technology resources. I plan to lead EZENET to a global presence as a leading developer of technological solutions and software development for the Financial and Internet markets across Internet and wireless communications."

As part of this re-organization, Gordon Ramer will be retiring from his position as Vice President effective February 29, 2000. Gordon Ramer has been with Ezenet since 1984, and has been key in the development of Ezenet's current products and services. Gordon Ramer will continue to contribute to the Company in a consulting role and will remain on the Board of Directors of Ezenet Corp.

![]()

EZENET INC. ("EZE -V") - NOT AWARE OF ANY NEWS OR IMPENDING OR MATERIAL CHANGE

TORONTO, ONTARIO (February 4, 2000) - It has come to the Corporation's attention that there has been unusual activity in the market for the Corporation's common shares traded on the Canadian Venture Exchange. The Corporation is obliged to advise that it is not aware of any news or impending or proposed material change that would explain recent market activity. TEL: (416) 482-3037 (EXT 231) Mr. Terry Rogers, CFO

![]()

EZENET APPOINTS NEW DIRECTOR

EZENET CLASSIFIED AS TIER 1 COMPANY BY CDNX

TORONTO, ONTARIO (January 27, 2000) - Haron Ezer President of EZENET Corp, announces the appointment of Jeffrey C. Coyne to the Board of Directors of EZENET. Jeffrey Coyne is Chairman of the Board of Directors of Valu-net International, Ltd., ("VNE"on the Canadian Venture Exchange), a Toronto based Internet related business and Chairman of the Board of Directors and CEO of Rebel Asset Management, Ltd., of Chapel Hill, North Carolina. He has been involved in a number of companies active in research and development of laser products for military applications, construction of condominium projects in California and Aruba and shopping malls in Aruba and Southern California. He was, formerly, Chairman of the Board of Directors and CEO of Divi Hotels, Inc., ("DIVI" on the NYSE), owner and operator of seventeen hotels, casinos and timeshare clubs in the Caribbean.

Jeffrey Coyne, who resides in North Carolina, USA, graduated with a Bachelor of Arts degree from the University of California at Berkeley in 1976 and a Juris Doctor degree from Duke University, School of Law, in 1979. He has been a senior lecturing fellow at Duke University School of Law, from 1994 to the present. He was also a former partner of Coudert Brothers, Attorneys at Law, New York and Graham and James, Attorneys at Law, San Francisco.

"Jeff Coyne brings to Ezenet Corp. the contacts necessary to expand our operations, in the future, into the expanding US marketplace", said Haron Ezer, President and CEO of Ezenet Corp. "He has extensive experience in dealing with US regulators and contacts in the key industries targeted for future growth. We are delighted to have him as part of our management team and he will bring a positive new dimension to our Board".

Haron Ezer, is pleased to announce that Ezenet has been classified as a Tier 1 Company by the Canadian Venture Exchange ("CDNX"). Companies listed on CDNX are classified in distinct tiers, based on financial performance, stage of development and financial resources. Tier 1 is the premier CDNX tier. It is reserved for the Exchange's most advanced issuers, those companies with the most significant resources and whose directors, officers and corporate governance structure complies with Exchange requirements.

| top | | new | 2000 | 1999 | 1998 | 1997 | 1996 | |

![]()